The Rental Market over the last few years has been very competitive with a greater supply of tenants than properties.

A lack of supply and huge demand is pushing rental prices - but why are there so many tenants and so few properties?

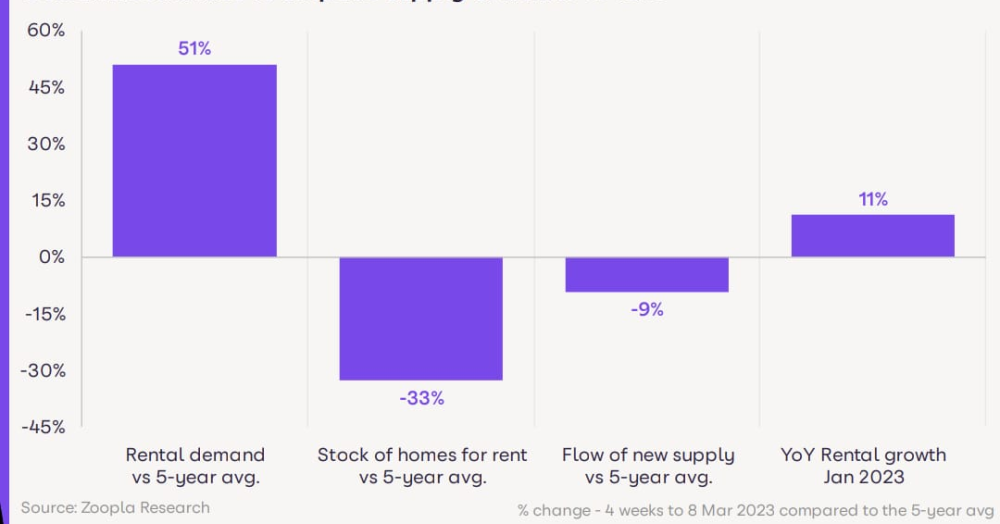

Rental asking prices are driven by many factors but at the core of what dictates the asking price is supply and demand if there are 10 rental properties for every tenant - tenants will more likely be choosy and Landlords may have to be flexible on price however if there are 10 tenants for every one property landlords can be choosy on whom they decide to let to and prices will be pushed up because of competition. The Rental Market over the last few years has been very competitive with a greater supply of tenants than properties. As you can see from the graph below demand increased by 51% vs the 5-year average while stock (supply) has reduced by 33%

3 things boosting demand for rental properties

- International students - Overseas students studying in the UK totalled 680,0003 in 2021/22, up 122,0003 in 2 years thanks to new visa rules. With time scales being uncertain the vast majority of students will be looking for renal properties increasing demand greatly in university locations.

- Immigration - Rental demand is also driven by the strength of the job market, which has shown resilience and currently boasts over 1 million vacancies, according to the latest data from the Office for National Statistics. While many of these jobs are filled by UK nationals, advanced economies worldwide are increasingly reliant on immigration to fill highly skilled roles. In early 2021, the UK government introduced significant changes to visa regulations to attract skilled talent, contributing to record-high net immigration of 504,000 individuals in the year to June 2022. This figure was further boosted by humanitarian schemes designed to support Ukrainians fleeing conflict, as well as a specific visa program aimed at British Overseas citizens seeking to relocate from Hong Kong to the UK.

- First-time buyers struggling - The housing market has been very competitive over the past few years with two record-breaking years for house price increases over 2020-2022 while at the same time, running costs have vastly increased along with mortgage rates meaning a lot of would-be first-time buyers have opted to rent.

3 reasons the supply of properties available to rent have decreased

- Mortgage Rates and Changes - The equity needed to buy new rented homes with a mortgage has been increasing in recent years as a result of rising house prices, lower rental yields and tighter lending criteria. This has been exacerbated over the last six months by rising mortgage rates. Meaning a larger deposit is now required while the potential return is less than previous because of higher mortgage rates.

- Other ways to earn from property - The rise of Airbnb and demand for short-term Lets have lured many Landlords away from the rental market. Zoopla estimates that approximately 8% of Landlords have moved to alternatives

- Tax and Legislation changes - To name a few The human habitation act, Tenant fees act, and EICR regulations have all been introduced in the last 5 years all creating more hoops for landlords to jump through to compliantly let their properties. Furthermore, tax changes have taken away from the profitability of letting property for some landlords by preventing them from being able to offset certain expenses from their tax bill.

Given the weaker economics for investors, there is an expectation of continued scarcity of rental homes throughout 2023. However, the completion of ongoing build-to-rent schemes will provide a glimmer of hope by adding supply to the mid to upper-end of the market in UK cities. Additionally, sellers may rent out their unsold homes due to a weak sales market, but this is not expected to significantly impact the outlook at this stage. While rental demand may not be as strong as last year due to weaker economic growth, it is predicted to remain above the 5-year average. The employment trends across UK cities, where rented homes and jobs are concentrated, will play a crucial role in determining rental demand. Affordability-wise, average rents expressed as a percentage of earnings are currently at or near ten-year highs in all regions except London, which will eventually slow down the pace of rental growth to 4-5% by the year-end.